10 Easy Accountant jobs in Canada in 2023

Many people from different parts of the world are interested in finding accountant jobs in Canada.

They say that a good accountant’s days are filled with nothing but balanced books, spreadsheets full of numbers, and worn-out calculators, but what if that was not the case?

One of these options is immigration to Canada and getting accountant jobs in Canada, if you’re an accountant, you already have many of the skills necessary to make this happen.

There is a high demand for accountants all across the world, and Canada is no exception.

In Canada, there are many well-paying accounting and finance employment open to newcomers. To help you get started in Canada, we’ve compiled a list of accountant jobs in Canada and finance positions open to foreign nationals.

However, you will find this post invaluable if you are new to Canada and hoping to get some accountant jobs in Canada.

Now let’s focus on Accountant jobs in Canada

Is Canada a good place for a new immigrant to work in finance?

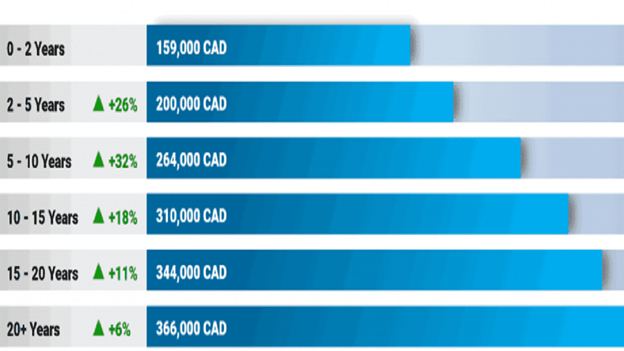

An individual’s pay in Canada in 2020 averaged around $169,000 CAD per year, with the exact amount depending on the individual’s level of experience and education.

Therefore, as a newcomer, if you are searching for accountant jobs in Canada, experience is one of the factors that determines your pay.

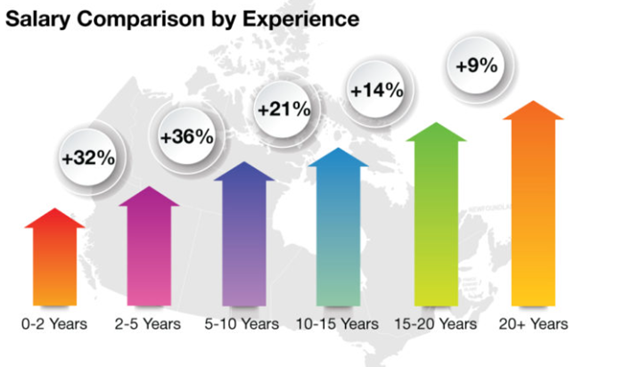

Here look at the salary comparison in 2020

In fact, this is not completely out of the realm of possibility in the business of accounting and finance…

In 2021, the average wage in the accounting and finance industry is projected to remain stable at $97,000 (or roughly $122,054.61 CAD).

This suggests that foreign nationals can easily find accountant jobs in Canada also in the finance sectors if they have relevant expertise and credentials.

When one considers the standard of living in Canada, as well as the cost of living and the accessibility of public transportation, it becomes clear that Canada is an appealing prospect for those seeking a career in finance.

Top 10 well-paid accountant jobs in Canada for new immigrants

· Cost Accounting Manager

· Business analyst,

· Financial controller

· Senior financial advisor

· Finance director

· Financial Advisor

· Accountant

· Payroll clerks

· Tax accountant

· Financial intern

1. Finance Director

The chief financial officer (CFO) receives reports from the finance director, an executive position within the finance department.

They rank among the top-paying professions in Canada’s accounting and financial sector.

As of 2021, a finance director in Canada can expect an average yearly compensation of roughly $253,000 CAD. Moreover, this wage spectrum shifts as one gains more experience, as displayed below.

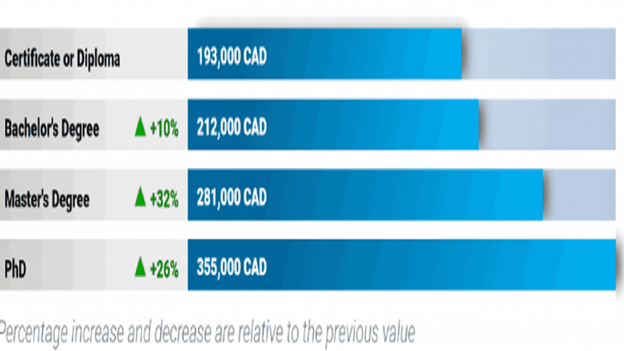

Accountant jobs in Canada salaries based on educational level

2. Cost accounting manager

A company’s planning, analysis, and financial information, as well as the recording of departmental and product expenses, are under the purview of the cost accounting manager.

The CFO or finance director is ultimately responsible for the actions of the manager of cost accounting.

In 2021, a cost accounting manager can expect an average yearly compensation of around 167,000 CAD.

This, however, might vary widely depending on their degree of expertise.

3. Business Analysts

One of the most important roles in the field of accounting and finance is that of the business analyst.

Business analysts are in high demand since companies of all sizes are always plotting their next moves in light of the present state of the economy in the United States and the rest of the world.

Business analysts in Calgary earn an average of $115,900 per year, more than in any other Canadian city.

In 2021, a business analyst can expect to make an average salary of around $154,000 CAD.

The wage range for Canadian financial employment is, as we’ve already established, highly dependent on the applicant pool’s amount of relevant experience.

4. Senior financial Advisor

Senior financial advisors are frequently sought out by companies to help them plan for their financial futures.

To do this, they develop strategies that are unique to each business and take into account its unique problems, difficulties, risk tolerance, and objectives.

In Canada, a senior financial advisor can expect an annual income of $60,000 to $80,000 every year

5. Financial Advisor

These experts advise their clients on how to maximize their financial and investing opportunities.

6. Financial Controller

Indeed, in Canada, the position of the financial controller is now the second highest paid in the field of finance.

A controller is responsible for directing the day-to-day operations of an organization’s financial systems, including accounting, ledger administration, accounts payable, and receivable.

A financial controller in Canada can expect to make around $131,000 CAD per year in 2021. This also has an association with seniority in the field. And according to scholastic background

7. Tax Accountant

A tax accountant performs some of the same duties as a regular accountant, but with an added focus on the tax needs of businesses.

Canadian tax advisors earn roughly 125,000 CAD per year, depending on experience.

8. Payroll Clerk

Entry-level payroll clerk positions are common in Canada’s financial sector. This is to say, they are the ones who are responsible for distributing the company’s monthly paychecks to the workers.

A payroll clerk’s duties may also include answering employees’ questions about payments and benefits.

Payroll clerks in Canada earn an average yearly compensation of roughly $107,000 CAD. This salary range is dependent on the candidate’s level of experience.

9. Accountant

It is impossible to keep tabs on a company’s finances without the services of an accountant.

A Canadian accountant can expect an average annual compensation of around $80,000. Experience determines this salary range.

10. Finance Intern

Internships in accounting and finance are available in Canada, and newcomers are welcome to apply. This will improve their finance experience.

Skills required to secure accountant jobs in Canada

In Canada, you need the following skills to get accountant jobs in Canada:

Excel skills are very good

Good understanding of the International Financial Reporting Standards (IFRS)

Money laundering prevention (AML)

The public accounting

Good understanding of GAAP (Generally Accepted Accounting Principles)

If you can speak English it is a plus for you

As a newcomer to Canada, the following certifications will also help you get accountant jobs in Canada fasters:

Professional Accountant Chartered (CPA)

Management Accountant Certified (CMA)

Chartered Financial Analysts (CFA)

Internal Auditor Certified (CIA)

Certification by the Canadian Payroll Association

Course in Canadian Securities.

Guide for Accountants Considering a Move to Canada

To begin, think about what is needed and how competent you are as an accountant.

Foreigners can find several accounting positions in Canada, many of which pay well and provide excellent prospects for professional development.

Furthermore, non-native speakers of English should be aware that some accounting roles fall under the category of regulated vocations, requiring foreign accountants to obtain a foreign qualification recognition.

If you want to become an accountant in Ontario as quickly as possible, it is recommended that you contact the Chartered Professional Accountants of Ontario (CPA) or the Public Accountants Council for the Province of Ontario for more information on the certification procedure.

It may be difficult, but not impossible, for foreign healthcare professionals to get the necessary qualifications to work in specific jobs in Canada.

Accounting Principles in Canada

So you’ve decided to move to Canada and work as an accountant there.

Every country has its own unique set of accounting rules, so it’s crucial to keep that in mind before accepting any accounting positions abroad.

Skilled foreign workers, like any other employee, desire to succeed in their new position and keep their job.

Don’t worry, CanadaCIS will make sure this never happens to you.

To save you time, we looked at some of Canada’s most crucial accounting regulations.